Unblocking OFAC-Sanctioned Assets for Personal Needs and Hardship Circumstances

Economic sanctions enforced by the U.S. Treasury’s Office of Foreign Assets Control (OFAC) are some of the most powerful tools in U.S. foreign policy. When a person or company is designated under programs like Executive Order 14024 (Russia), 13599 (Iran), or 13692 (Venezuela), all their property and assets under U.S. jurisdiction are immediately frozen.

I. Introduction: The Human Consequences of Asset Blocking

Economic sanctions enforced by the U.S. Treasury’s Office of Foreign Assets Control (OFAC) are some of the most powerful tools in U.S. foreign policy. When a person or company is designated under programs like Executive Order 14024 (Russia), 13599 (Iran), or 13692 (Venezuela), all their property and assets under U.S. jurisdiction are immediately frozen.

While these measures aim to protect national security, the personal impact can be severe. Funds needed for medical care, rent, or family support can suddenly become inaccessible, creating real hardships.

To help address these situations, OFAC allows individuals to apply for a specific license that may let them access or use frozen assets for humanitarian or personal purposes, providing a legal path to mitigate these urgent challenges.

II. Legal Framework and Authority

OFAC’s authority comes from the International Emergency Economic Powers Act (IEEPA), 50 U.S.C. §§1701–1706, which gives the President and the Treasury the power to block transactions involving foreign persons that could threaten U.S. interests.

At the same time, IEEPA allows for flexibility. Under 31 C.F.R. §501.801–802, OFAC can issue specific licenses that authorize transactions that would otherwise be prohibited — as long as they align with U.S. foreign policy and national security goals. These licenses can provide limited access to blocked assets in cases of humanitarian need or personal hardship, offering a legal way to address urgent financial needs.

III. When OFAC Considers Hardship or Humanitarian Requests

Each sanctions program allows exceptions for personal or humanitarian use. Common examples include:

- Medical Emergencies: Accessing funds for hospital stays, surgeries, or critical treatments in the U.S. or abroad.

- Family Support: Sending money to dependents lawfully living in the U.S. to cover rent, food, or childcare.

- Educational Expenses: Using blocked accounts to pay tuition or related school costs.

- Funeral or Legal Costs: Paying U.S. attorneys or funeral homes for necessary services.

To qualify, requests must show that the funds are being used solely for personal or humanitarian purposes and are not benefiting other sanctioned parties or funding business activities.

IV. Evidentiary and Procedural Requirements

To succeed with a hardship application, it’s important to provide a clear, well-documented record. Key elements usually include:

- Affidavit of Need: A sworn statement explaining your financial hardship, family situation, and lack of alternative income sources.

- Proof of Ownership: Bank or corporate records showing that the funds belong solely to you.

- Hardship Documentation: Bills, medical invoices, rent statements, or tuition notices that demonstrate urgent financial need.

- Non-Commercial Declaration: A written assurance that the funds will not be used for business, investment, or third-party purposes.

- Compliance Certification: A statement acknowledging OFAC oversight and committing to provide post-transaction reporting if required.

This structured approach helps ensure that your request is clear, credible, and aligned with OFAC’s regulations.

V. Illustrative Case Examples

1. Medical Hardship Relief

A Russian national sanctioned under E.O. 14024 faced a serious challenge when her U.S. bank account was frozen, leaving her unable to pay for emergency cardiac surgery in New York. With the help of legal counsel, she submitted an OFAC license petition supported by hospital bills and letters from her physicians. Within just 45 days, OFAC approved a specific license allowing a one-time transfer of $28,000 directly to the hospital, strictly for the purpose of covering her treatment.

2. Family Maintenance

A Venezuelan citizen designated under E.O. 13692 needed to transfer $2,000 per month from a blocked account to support his U.S. citizen spouse and young child. He submitted tax returns, a rental agreement, and sworn affidavits demonstrating his family’s dependency. OFAC approved a limited, periodic license for six months, allowing the transfers while requiring periodic reporting to ensure compliance.

3. Legal Representation

OFAC frequently issues specific licenses allowing sanctioned individuals to pay U.S. attorneys representing them in administrative or judicial matters (see OFAC FAQ 627). In 2024, a blocked Iranian entrepreneur received authorization to pay his New York-based lawyer through an escrowed release of $50,000, ensuring the funds were used solely for legal services.

VI. Filing Procedure and Timelines

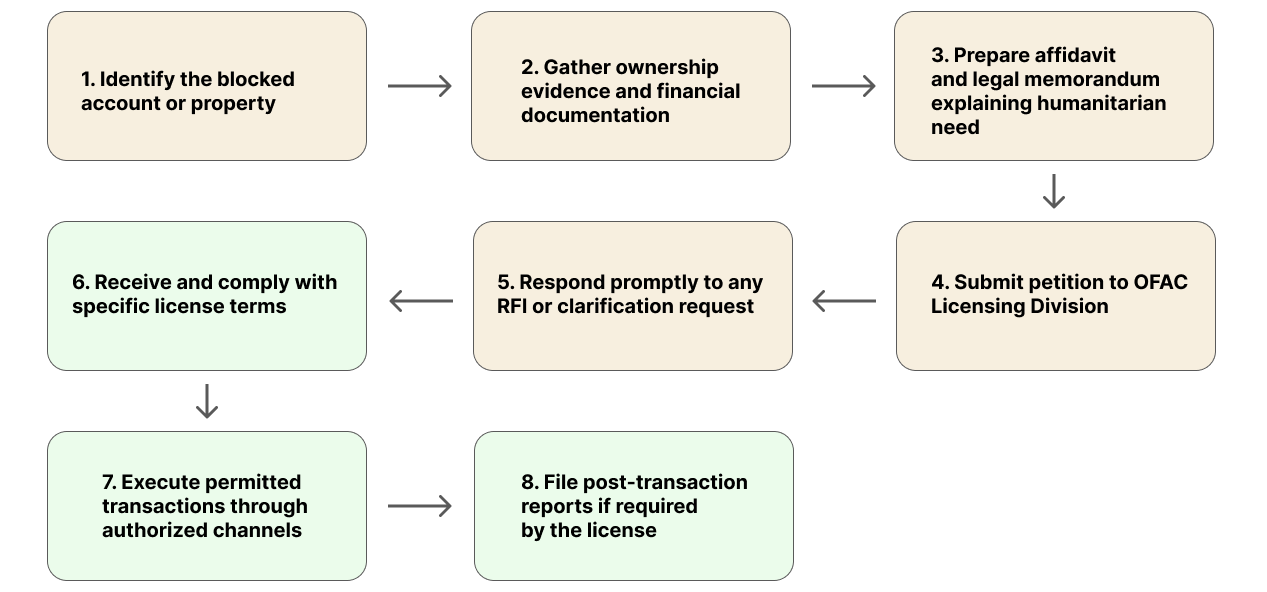

Applications for unblocking or hardship licensing are submitted through the OFAC Licensing Division via the online Form TD F 90-22.54 or written correspondence. The process involves:

- Submission: Detailed petition and exhibits describing the assets and purpose of the request.

- Acknowledgment: OFAC assigns a case number within two to three weeks.

- Review and Clarification: Additional documentation may be requested through a “Request for Additional Information” (RFI).

- Determination: Depending on complexity, decisions typically take between 60 and 180 days, though urgent medical or humanitarian cases can be expedited.

- License Issuance: The final document specifies transaction limits, expiration dates, and mandatory reporting obligations.

VII. Strategic Legal Considerations

OFAC applies a totality-of-circumstances standard, assessing both the humanitarian necessity and the potential risk to sanctions policy. Applicants can strengthen their case by:

- Emphasizing a U.S. humanitarian nexus (e.g., U.S. family members, legal residence, or treatment in a U.S. hospital).

- Demonstrating complete separation from other sanctioned entities or government bodies.

- Implementing compliance controls, such as routing funds through licensed U.S. banks or escrow agents.

- Submitting third-party corroboration (e.g., physician statements, landlord confirmations).

- Citing precedent and published OFAC FAQs relevant to the hardship claimed.

VIII. Common Pitfalls and Denial Reasons

OFAC may deny or delay license requests if:

- The funds appear to benefit a commercial enterprise or state-owned entity rather than the individual.

- Ownership of the funds is unclear or contested.

- Submitted documentation is incomplete or inconsistent.

- The applicant has previously tried to bypass sanctions using informal transfers or cryptocurrency.

Under 50 U.S.C. §1705, evading sanctions—including through digital assets or third-party intermediaries—is a federal crime, carrying substantial fines and potential imprisonment. Even humanitarian intentions do not excuse unauthorized transfers.

IX. Step-by-Step Flow of the Hardship Licensing Process

X. Conclusion

While OFAC sanctions are strict, they are not meant to cause unnecessary human hardship. Individuals facing serious difficulties—such as medical emergencies, supporting dependent family members, or essential living expenses—can seek relief through a specific license.

A well-prepared petition, backed by credible documentation, can result in partial or full access to frozen funds. Legal guidance is strongly recommended to ensure compliance, properly frame the request, and communicate effectively with OFAC officials.

Friling Law, PLLC assists clients around the world in preparing and submitting OFAC license applications and humanitarian unblocking petitions under the sanctions programs for Russia, Iran, Venezuela, and Cuba.

Turkish

Turkish  English

English  Español

Español  Русский

Русский  Persian (فارسی)

Persian (فارسی)  Arabic (العربية)

Arabic (العربية)  简体中文 (中国)

简体中文 (中国)