Reconsidering Anti-Dumping Tariffs: Legal Framework, Jurisprudence, and Practical Strategies for Reconsideration and Revocation

Anti-dumping duties are among the most powerful instruments in global trade regulation. They aim to level the playing field by offsetting the impact of goods sold at “unfairly low” prices, protecting domestic producers from economic harm.

I. Introduction

Anti-dumping duties are among the most powerful instruments in global trade regulation. They aim to level the playing field by offsetting the impact of goods sold at “unfairly low” prices, protecting domestic producers from economic harm.

Since the adoption of the World Trade Organization’s Anti-Dumping Agreement, more than 600 measures have been implemented worldwide. The United States alone enforces over 400 active anti-dumping and countervailing duty orders, covering everything from steel and aluminum to shrimp and solar panels.

Yet, many of these duties remain in place long after their original purpose has faded — distorting trade and inflating costs even after markets have stabilized. For importers and exporters, seeking to review, reduce, or revoke such measures requires both legal precision and strategic planning.

This article explores the complete lifecycle of an anti-dumping measure — from the initial investigation to reconsideration and eventual revocation — with a focus on the legal tools available under U.S. and WTO law, supported by landmark cases and practical guidance for businesses.

II. Legal Foundations and Institutional Structure

A. WTO Legal Basis

The global framework for anti-dumping regulation is established under two key instruments:

- Article VI of the GATT 1994, and

- The Agreement on Implementation of Article VI, commonly known as the WTO Anti-Dumping Agreement.

Under Article VI, dumping occurs when a product is sold in a foreign market at a price lower than its “normal value” — typically the price at which it is sold in the exporter’s domestic market.

The system is built around three core principles:

- Fair comparison: Export prices must be compared to home-market prices on an equivalent basis.

- Causation: The domestic industry’s injury must result directly from dumping, not from unrelated market factors.

- Transparency and due process: All interested parties must have a fair opportunity to participate and respond during the investigation.

B. U.S. Legal Framework

U.S. anti-dumping law is governed by Title VII of the Tariff Act of 1930 (19 U.S.C. §§1673–1677n).

Enforcement authority is divided between two agencies:

- The Department of Commerce — determines whether dumping has occurred and calculates the size of the dumping margin.

- The U.S. International Trade Commission — evaluates whether the U.S. industry has suffered material injury or faces a threat of injury due to dumped imports.

Together, these agencies operate a dual-review system: the Department of Commerce focuses on pricing practices, while the International Trade Commission examines causation and market impact.

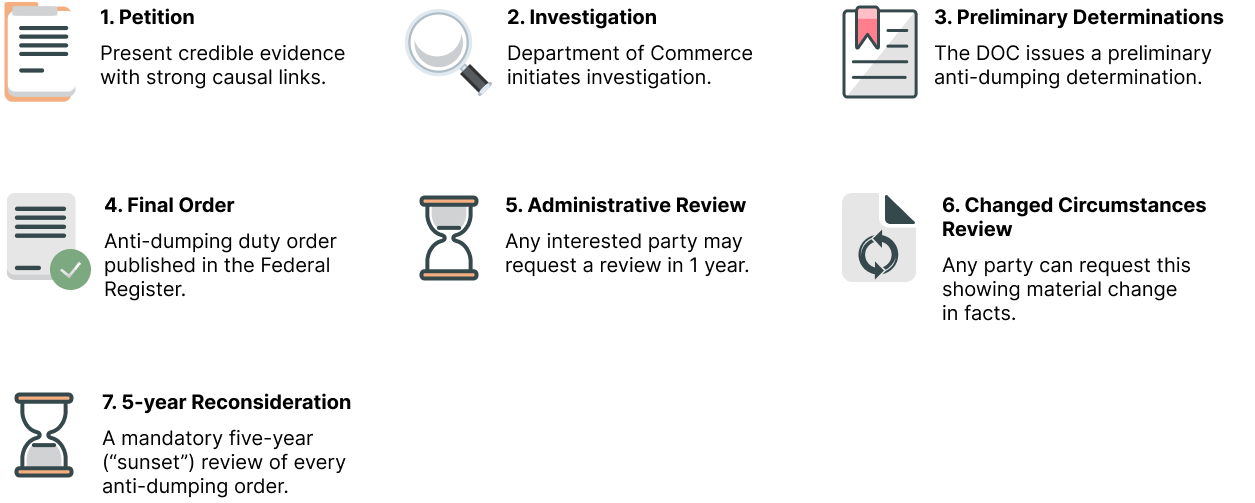

III. Step-by-Step Process of an Anti-Dumping Investigation

Step 1: Petition

Initiation of an Investigation

A petition may be filed by domestic producers or industry associations representing at least 25% of total U.S. production of the product in question. To proceed, the petition must present credible evidence of three key elements:

- Dumping — sales at less than fair value;

- Material injury — harm to the U.S. industry; and

- Causal link — a direct connection between the dumped imports and the injury suffered.

Practical insight: Petitions lacking adequate data or credible support are often dismissed before formal initiation, underscoring the importance of thorough preparation and expert economic analysis.

Step 2: Investigation

If the Department of Commerce finds “reasonable evidence” of dumping, it formally initiates an investigation. Notice is published in the Federal Register.

Step 3: Preliminary Determinations

- The Department of Commerce issues a preliminary dumping determination and may require importers to post cash deposits equivalent to the estimated margin.

- The International Trade Commission issues a preliminary injury determination.

Step 4: Final Determination and Order

If both the Department of Commerce and the International Trade Commission issue affirmative final determinations, the Department of Commerce publishes an anti-dumping duty order in the Federal Register — effectively imposing a new import tariff specific to the exporter or country.

Step 5: Administrative Review (19 U.S.C. §1675(a))

After one year, any interested party — including importers, exporters, or domestic producers — may request an administrative review of the anti-dumping order. During this process, the Department of Commerce reexamines the exporter’s pricing and cost data over the review period to determine whether the dumping margin has changed.

If the review shows that the exporter sold goods at fair value, the Department of Commerce may lower or even eliminate the duty. Conversely, if new evidence reveals continued or increased dumping, the margin — and therefore the duty — may rise.

Example: In Ball Bearings from Japan, periodic reviews lowered margins significantly as costs normalized, leading to partial revocation.

Step 6: Changed Circumstances Review (19 U.S.C. §1675(b))

This review may be requested at any time upon showing material change in facts — such as restructuring, ownership change, or altered market dynamics.

Example: In Frozen Warmwater Shrimp from India (2017), exporters successfully petitioned for changed circumstances after demonstrating corporate restructuring and cessation of below-cost sales.

Step 7: Five-Year Reconsideration (Sunset Review)

Every anti-dumping order must undergo a mandatory five-year (“sunset”) review under 19 U.S.C. §1675(c). The Department of Commerce determines whether revocation would likely lead to continued or renewed dumping; the International Trade Commission determines whether material injury would recur.

If both agencies issue negative findings, the order must be revoked.

If either agency affirms, the order remains for another five years, subject to further review.

Example: In Steel Nails from China (2020), the International Trade Commission found that revocation would not lead to renewed injury, resulting in full termination of the order.

IV. Judicial Review and International Remedies

A. U.S. Court Review

Adverse determinations can be appealed to the U.S. Court of International Trade within 30 days of publication.

The CIT reviews the case under the “substantial evidence” standard — meaning it generally defers to the Department of Commerce and International Trade Commission unless their findings are shown to be arbitrary, capricious, or unsupported by the record.

Decisions of the Court of International Trade may then be further appealed to the U.S. Court of Appeals for the Federal Circuit, which provides the final layer of judicial oversight in U.S. anti-dumping cases.

Notable Case:

NSK Ltd. v. United States (2003) — the Federal Circuit confirmed that zeroing in administrative reviews was inconsistent with U.S. obligations under the WTO Anti-Dumping Agreement.

B. WTO Dispute Settlement

If an anti-dumping order conflicts with WTO law, the affected country may file a dispute complaint under the WTO Dispute Settlement Understanding. Successful challenges can compel the respondent to amend or withdraw measures.

Examples:

- U.S. — Hot-Rolled Steel from Japan (2001): WTO condemned “zeroing” in margin calculations.

- EU — Biodiesel (2016): Panel ruled against EU’s cost-adjustment methodology.

These cases illustrate that WTO jurisprudence strongly influences domestic anti-dumping practices, even in non-directly enforceable contexts.

V. Economic and Policy Critiques

A. Hidden Protectionism

Empirical evidence suggests that many anti-dumping actions are directed not at predatory pricing, but at legitimate international price competition.

In practice, anti-dumping duties often remain in place for a decade or longer, providing sustained protection to domestic industries — yet at the cost of higher input prices for downstream manufacturers and consumers, and reduced overall market efficiency.

B. Volatility and Currency Fluctuations

Exchange-rate fluctuations can significantly distort the calculation of dumping margins. A depreciation of the exporter’s currency may artificially inflate dumping margins, even when export prices remain stable in the exporter’s local market. This phenomenon has been a recurring challenge in investigations involving currencies such as the Japanese yen and the Chinese yuan, raising questions about the fairness and accuracy of margin determinations.

C. Burden on Small and Medium Businesses and Exporters

Responding to Department of Commerce questionnaires can be an enormous undertaking, often exceeding 1,000 pages and requiring detailed financial and operational disclosures. Many smaller exporters find the process too burdensome and opt not to participate. In such cases, the Department of Commerce may apply “adverse facts available” margins, which can be punitive — sometimes exceeding 100% of the export value — effectively imposing a severe tariff by default.

VI. Practical Legal Strategies for Reconsideration and Revocation

1. Prepare early for sunset reviews

Begin gathering evidence well before the five-year mark. Make sure you have clear, verifiable documentation showing that:

- Export prices now reflect fair market value;

- The exporter is no longer selling below cost; and

- Domestic producers have not suffered injury over multiple consecutive years.

Compiling this information early can strengthen a request for administrative review or duty revocation.

2. Engage in administrative reviews strategically

If dumping margins have dropped significantly, consider petitioning for a partial revocation under 19 C.F.R. §351.222.

Support your request with clear documentation showing:

- Improved cost structures that justify current pricing;

- Independent pricing mechanisms demonstrating fair market value; and

- Long-term contracts or agreements reflecting stable, consistent market behavior.

Careful preparation can make the difference between a successful revocation and a prolonged duty order.

3. Use changed circumstances review as a flexible tool

If a company merges, restructures, or stops dumping, it can request a mid-term review to reconsider the duty order. To make a strong case, submit:

- Audited financial statements showing current cost and pricing structures;

- Detailed sales data demonstrating normal market behavior; and

- Affidavits or declarations explaining the corporate or economic changes.

This review gives companies a chance to adjust or lift duties before the standard administrative cycle.

4. Judicial challenge when agencies overreach

If the Department of Commerce or the International Trade Commission makes a decision without solid evidence, you can appeal to the U.S. Court of International Trade within the required deadlines. Focus your appeal on procedural or evidentiary issues, such as:

- Lack of disclosure of key information;

- Improper selection of samples or data;

- Bias or arbitrary decision-making.

The Court of International Trade reviews whether the agency acted reasonably and based its conclusions on substantial evidence, giving you a chance to overturn or modify unfavorable rulings.

5. Leverage WTO mechanisms

When a foreign exporter or government faces persistent or systemic issues — like controversial pricing adjustments (zeroing) or the use of surrogate values — they can work with trade law experts to bring a case to the World Trade Organization.

If the WTO rules in their favor, it can prompt the United States to adjust its anti-dumping practices through formal procedures under the Uruguay Round Agreements Act (Sections 123 and 129), helping restore fairer treatment in future trade.

VII. Examples of Successful Revocations

- Ball Bearings from Japan (2011) — Revoked after evidence showed price normalization and no likelihood of resumed dumping.

- Hot-Rolled Steel from Russia (2019) — Revocation followed six consecutive years of positive industry performance and stable import prices.

- Crawfish Tail Meat from China (2014) — Changed-circumstances review led to revocation after exporters demonstrated cessation of unfair trade practices.

These cases demonstrate that revocation is achievable when petitioners present robust, documented economic evidence aligned with statutory criteria.

VIII. Compliance Tips for Exporters and Counsel

|

Objective |

Legal Tool |

Key Evidence Required |

|---|---|---|

|

Reduce dumping margin |

Administrative review |

Updated sales data, cost analysis |

|

Remove outdated duties |

Sunset review |

Proof of market recovery, stable prices |

|

Early termination |

Changed-circumstances review |

Corporate change, cessation of dumping |

|

Challenge procedural error |

Court of International Trade appeal |

Administrative record, due process violation |

|

International recourse |

WTO dispute |

Government sponsorship, treaty breach |

IX. Policy Reform and Recommendations

- Integrate economic reality tests: Adopt competition-law principles evaluating consumer harm and efficiency.

- Shorten review cycles: Mandate interim assessments every three years instead of five.

- Increase Transparency: Publish full public summaries of Department of Commerce methodologies and margin calculations.

- Harmonize with WTO standards: Eliminate zeroing permanently and codify fair-comparison obligations.

- Promote cooperation mechanisms: Develop multilateral review forums to share best practices and prevent retaliatory escalation.

X. Conclusion

Anti-dumping duties play an important role in protecting domestic industries and ensuring fair competition. But over time, they can outlive their original purpose, unintentionally restricting healthy market activity.

Exporters aren’t powerless. Through tools like administrative reviews, changed-circumstances petitions, and sunset reviews, businesses can seek relief from outdated or excessive duties. At the same time, governments and trade bodies must continue refining the system to make sure trade defense measures protect fairness — without becoming unnecessary barriers that distort the market.

Professional law firms advise clients on the full spectrum of WTO and U.S. trade remedy procedures — from petition defense to reconsideration and revocation — ensuring compliance, transparency, and fairness in a rapidly changing global market.

Turkish

Turkish  English

English  Español

Español  Русский

Русский  Persian (فارسی)

Persian (فارسی)  Arabic (العربية)

Arabic (العربية)  简体中文 (中国)

简体中文 (中国)