How to Release OFAC-Blocked Funds: A Guide to Unfreezing Frozen Accounts, Obtaining OFAC Licenses, and Correcting Sanctions Holds

When a bank tells you your funds are “OFAC-blocked,” it means they believe U.S. sanctions law requires them to freeze the money, or other property, until there’s a clear legal reason to release it. In reality, getting blocked funds released isn’t about arguing or persuading the bank; it’s about following the right process and providing a complete, bank-ready package of evidence.

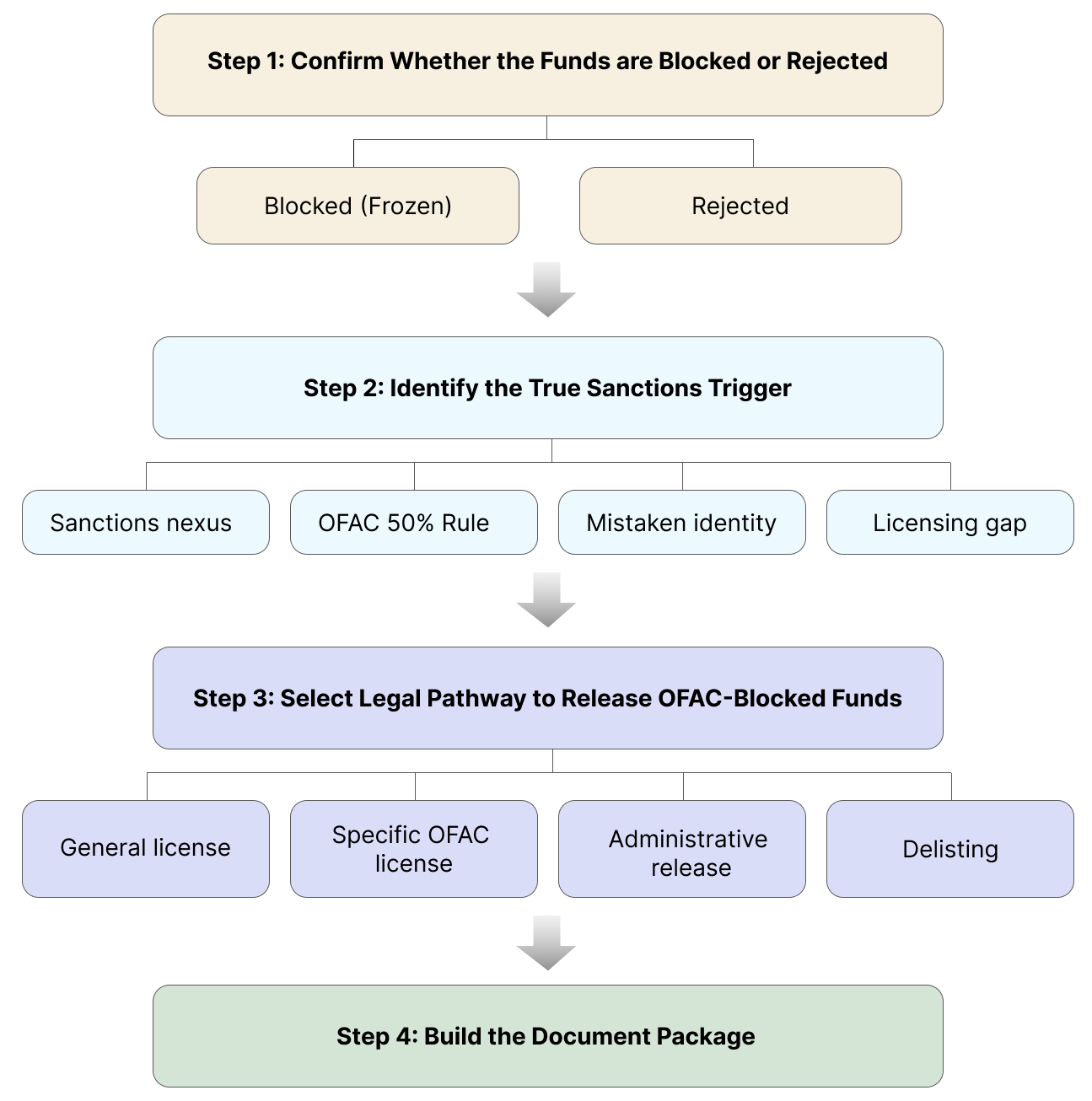

Step 1: Confirm Whether the Payment Was “Blocked” or “Rejected”

This is the first fork in the road:

- Blocked (frozen): The funds are sitting in a blocked account and can’t move until there’s a lawful reason to release them.

- Rejected: The bank simply won’t process the transaction – often returning it outright. The steps to resolve this can be different from a blocked account.

Practical tip: Always ask the bank, in writing, for key details: transaction date, amount, counterparties, wire or SWIFT reference, and any internal case or block reference. You may not get every detail, but you need enough information to tie the hold to a specific legal pathway.

Step 2: Identify the True Trigger for the Sanctions Hold

Most blocked-funds situations fall into one of four categories:

- True sanctions nexus

The transaction involves a sanctioned party or is restricted under a specific program. - OFAC 50 Percent Rule exposure

The counterparty might not be on the SDN List, but is treated as blocked because it’s owned—fully or in part—by one or more blocked persons. - False positive / mistaken identity

The bank’s screening system flagged the wrong person or entity—often due to a similar name, typos, or incomplete identifiers. - Licensing gap

The transaction might be allowed under a license, but no general license applies – or the bank won’t rely on it – so a specific OFAC license is needed.

Step 3: Select the Correct Legal Pathway to Release OFAC-Blocked Funds

Pathway A: Rely on a General License (When It Clearly Applies)

If a general license explicitly covers your type of transaction, it may allow the funds to move without a case-by-case license. But there’s a catch: every condition of the general license must be met.

Why this sometimes fails in practice: Many banks won’t release funds just because you say a general license applies. They usually ask for a brief legal memo and supporting documents—like contracts, invoices, details about the end-use, counterparty diligence, and ownership information—before taking action.

Pathway B: Apply for a Specific OFAC License (The Most Common Route)

When no general license fits, the usual solution is a specific OFAC license authorizing the transaction and/or the release of blocked funds.

What a strong license request looks like (bank-ready):

- A precise request: Amount, holding bank/account, beneficiary, timing, and purpose.

- Funds trail: Wire instructions, confirmations, SWIFT references, and bank notices.

- Transaction documents: Contracts, invoices, shipping or service details, correspondence.

- Party diligence: IDs, corporate registry extracts, addresses, and UBO (beneficial owner) evidence.

- Ownership analysis: A clean beneficial ownership chart—especially important if the OFAC 50% Rule applies.

- Compliance undertakings: How proceeds will be used and assurances that blocked persons won’t benefit outside the authorized scope.

Pathway C: Administrative Release for Mistaken Identity / False Positive

If funds were blocked by mistake—due to a name match or screening error—the goal is to guide the bank through an administrative release process.

What typically helps win these cases:

- Government-issued ID (or, for entities, formation documents, good standing certificates, registry extracts).

- Clear disambiguators: date of birth, passport numbers, address history, corporate IDs.

- Proof of non-match: showing why you are not the listed person or entity.

- Ownership proof, if relevant, to eliminate 50% Rule concerns.

Key practical point: Even with strong evidence, banks often won’t release funds until internal approvals are complete—and in many cases, they escalate internally to get OFAC “comfort.”

Pathway D: Delisting (If the Client Is Actually Designated)

If the client, entity, or property is actually on the OFAC list, releasing funds may require:

- A specific license for any limited, permitted release, and/or

- A formal delisting petition to address the root issue.

Important: Delisting is not a shortcut. It’s a separate administrative process with its own evidence and procedural requirements.

Step 4: Build the Document Package That Prevents Delays

A strong submission to a bank (or to OFAC) usually includes four key components:

A. Identity and authority

- Government-issued IDs

- Corporate formation document

- Evidence of signatory authority or Power of Attorney, if needed

B. Transaction spine (non-negotiable)

- Payment instructions

- Wire or SWIFT references

- Invoices and contracts

- Bank notices

C. Parties and ownership

- Beneficial ownership chart

- Supporting documentation, especially if ownership is layered or complex

D. One-page legal summary

- What kind of pathway is this? General license? Specific license? False positive?

- What exactly are you asking to authorize—amount, beneficiary, and purpose?

Practical reality: The three fastest ways to turn a fixable block into a months-long stalemate are missing wire references, missing invoices, or unclear ownership. Make sure your packet is complete and clear from the start.

Common Reasons a Funds-Release Request Stalls

- The client provides only a story, “please unblock my funds”, without any supporting documents.

- Ownership is unclear, raising potential 50% Rule concerns, so the bank can’t move forward.

- The requested relief is too broad or not clearly defined.

- The bank’s compliance team needs confirmation from OFAC before they can act.

In short: without a clear, documented, and properly scoped request, even straightforward blocks can get stuck for weeks or months.

FAQ: OFAC-Blocked Funds (Client-Facing)

What does “OFAC-blocked funds” mean?

It means your bank has frozen the money because U.S. sanctions rules may prohibit the transaction—or require the funds to be held until there’s a lawful basis to release them.

Blocked vs. rejected—why does it matter?

Blocked funds sit in an account and usually need an authorization or error-release process to move. Rejected payments are returned outright and don’t sit in limbo.

Why are my funds blocked if I’m not on the SDN List?

Several reasons: a false positive from the bank’s screening system, ownership complications under the 50 Percent Rule, or a sanctions nexus involving another party or jurisdiction.

Can my bank release the funds if it’s a false positive?

Sometimes—but banks usually need to complete internal checks first. Often, they’ll also seek “comfort” from OFAC before releasing the funds. Your job is to provide clear proof that you are not the listed party.

Do I need a specific OFAC license to release blocked funds?

If no general license clearly applies—or if the bank won’t rely on it—a specific OFAC license is usually the most straightforward path.

What documents do I need for an OFAC license application?

At a minimum:

- Funds trail (wire/SWIFT references)

- Transaction documents (contracts, invoices)

- Identity and corporate documents

- Beneficial ownership information

How long does it take to unblock OFAC funds?

There’s no fixed timeline. It depends on the sanctions program, how complete your submission is, the bank’s compliance review, and whether OFAC asks for additional details.

Can I “reroute” the money through another bank to fix it?

Usually not. If the sanctions risk still exists, moving the money can trigger the same issues—and may even increase compliance exposure.

What if my company is actually designated?

Any movement will likely require a specific license. For a permanent solution, a delisting petition may be necessary.

Conclusion

Releasing OFAC-blocked funds is rarely just a matter of asking your bank to “unfreeze” your account. It’s a highly technical, fact-specific process that sits at the crossroads of U.S. sanctions rules, bank compliance procedures, beneficial ownership analysis (including the 50 Percent Rule), and OFAC licensing or administrative processes. Even small missteps – like confusing a blocked payment with a rejected one, leaving out a SWIFT reference, or failing to clearly document ownership – can cause significant delays or create additional compliance risk.

Because these cases are complex and can carry serious civil, and sometimes criminal, exposure, it’s best to treat OFAC-blocked funds as a specialized sanctions matter. Engaging experienced OFAC counsel early helps ensure the right pathway is chosen, whether that’s relying on a general license, applying for a specific license, pursuing an administrative release, or initiating a delisting. Counsel can also prepare a “bank-ready” evidentiary package and manage all communications with the bank and OFAC to keep the process on track.

Persian (فارسی)

Persian (فارسی)  English

English  Español

Español  Русский

Русский  Turkish

Turkish  Arabic (العربية)

Arabic (العربية)  简体中文 (中国)

简体中文 (中国)