Whistleblower Retaliation: Enforcement Trends, Legal Protections, and Emerging Risks for Employers

In recent years, whistleblower protection laws have evolved significantly across both public and private sectors. Enhanced enforcement by agencies such as the Securities and Exchange Commission (SEC), Occupational Safety and Health Administration (OSHA), and the Consumer Financial Protection Bureau (CFPB) reflects a clear federal commitment to supporting individuals who report misconduct.

For organizations, this shift underscores the importance of maintaining robust compliance and anti-retaliation policies. Even subtle forms of retaliation can expose employers to serious legal, financial, and reputational risks. For employees, it signals expanded access to legal remedies and, in certain cases, substantial monetary awards for reporting unlawful activity in good faith.

Defining Retaliation in the Whistleblower Context

Whistleblower retaliation refers to any negative employment action taken in response to an employee’s protected disclosure or involvement in an investigation. Legally, retaliation claims are generally evaluated through three core elements:

- Protected Activity: The employee engaged in conduct safeguarded by law, such as reporting fraud, filing a formal complaint, or providing testimony.

- Adverse Action: The employer took a materially negative step, which may include termination, demotion, harassment, or other unfavorable treatment.

- Causal Connection: The adverse action was motivated—at least in part—by the employee’s whistleblowing.

Courts interpret “adverse action” broadly. It is not limited to termination but can include more subtle forms of retaliation, such as poor performance reviews, exclusion from key projects, or denial of advancement opportunities. Even minor acts that could discourage others from reporting misconduct may be sufficient to establish a claim.

Principal Federal Statutes Protecting Whistleblowers

1. The Sarbanes–Oxley Act of 2002 (SOX), 18 U.S.C. §1514A

The Sarbanes–Oxley Act (SOX) provides protections for employees of publicly traded companies who report suspected fraud against shareholders or violations of Securities and Exchange Commission (SEC) regulations. It prohibits retaliation against individuals who raise concerns about corporate misconduct, ensuring they can report in good faith without fear of adverse consequences.

Key Features:

- Coverage extends to subsidiaries and affiliates.

- Complaints must be filed with OSHA within 180 days of the retaliatory act.

- Remedies include reinstatement, back pay, and special damages for emotional distress.

Courts have interpreted SOX broadly. In Lawson v. FMR LLC, 571 U.S. 429 (2014), the Supreme Court confirmed that SOX protections extend to employees of private contractors serving public companies.

2. The Dodd–Frank Wall Street Reform and Consumer Protection Act (2010)

The Dodd–Frank Act created the SEC Whistleblower Program to encourage the reporting of securities law violations. Eligible whistleblowers may receive monetary awards ranging from 10% to 30% of sanctions collected in cases where penalties exceed $1 million. The program also provides strong protections against retaliation, reinforcing transparency and accountability within financial markets.

Key Aspects:

- Protection applies to individuals reporting directly to the SEC or internally under Digital Realty Trust v. Somers, 138 S. Ct. 767 (2018).

- Retaliation claims can be brought directly in federal court without exhausting administrative remedies.

- Employers face penalties for using confidentiality or severance agreements that deter whistleblowing, as demonstrated in recent SEC enforcement actions.

3. The Consumer Financial Protection Act (CFPA), 12 U.S.C. §5567

Administered by OSHA, the CFPA protects employees of consumer financial institutions who report violations of consumer protection laws. The statute prohibits retaliation in any form — including termination, demotion, or intimidation — against individuals who raise compliance concerns. Recent enforcement actions highlight OSHA’s firm stance on retaliation, with some orders requiring reinstatement and back pay exceeding $1 million.

4. The False Claims Act (FCA), 31 U.S.C. §3730(h)

The FCA’s qui tam provisions allow private individuals — known as relators — to file lawsuits on behalf of the U.S. government against entities accused of defrauding federal programs. Whistleblowers are protected from retaliation and may receive between 15% and 30% of the funds recovered in successful actions. Landmark rulings, including U.S. ex rel. Howard v. Arkansas Children’s Hospital, have reinforced the FCA’s broad remedial intent and confirmed that whistleblowers may also seek emotional distress and punitive damages where warranted.

5. Environmental and Safety Whistleblower Statutes

Beyond the corporate and financial sectors, more than twenty laws administered by OSHA extend whistleblower protections across diverse industries. These statutes ensure that employees in critical sectors can report violations affecting public safety or environmental integrity without fear of retaliation.

Examples include:

- Clean Air Act

- Safe Drinking Water Act

- Surface Transportation Assistance Act (STAA)

- Energy Reorganization Act (ERA)

Each statute sets its own filing deadlines — typically ranging from 30 to 180 days — along with specific procedural requirements. This variability makes early legal consultation essential to preserve rights and build a strong retaliation claim.

Remedies and Enforcement

Remedies for whistleblower retaliation vary depending on the statute but generally include:

- Reinstatement to the employee’s previous position

- Back pay with interest

- Compensatory and punitive damages

- Attorney’s fees and litigation costs

- Front pay when reinstatement is not feasible

In Halliburton, Inc. v. Administrative Review Board (5th Cir. 2014), the court confirmed that even subtle forms of intimidation—such as threats of blacklisting—can support compensatory awards under SOX, highlighting that retaliation is not limited to overt actions.

Retaliation Investigations and Employer Liability

Federal regulators are increasingly treating retaliation itself as a standalone violation. The SEC, for example, has levied multi-million-dollar fines on companies that:

- Enforced nondisclosure agreements preventing employees from reporting to regulators; or

- Failed to disclose internal findings of retaliation.

In 2023, the SEC imposed a $10 million fine on a Fortune 500 technology company for requiring departing employees to waive their whistleblower rights — a record-setting penalty that underscores the agency’s heightened scrutiny of anti-retaliation compliance.

Employers may also face exposure under Title VII of the Civil Rights Act and the National Labor Relations Act (NLRA) when retaliatory conduct intersects with discrimination or protected concerted activity, further emphasizing the need for proactive compliance programs.

Strategic Considerations for Whistleblowers and Counsel

- Early Legal Consultation: Statutory deadlines are strict, and missing the filing window can permanently bar claims. Early engagement with counsel ensures timely action and preservation of evidence.

- Confidentiality and Anonymity: The SEC and CFTC permit anonymous submissions through legal counsel.

- Documentation: Maintaining detailed, contemporaneous records — such as emails, memorandaб etc. — strengthens causation arguments and credibility.

- Parallel Proceedings: Coordination between OSHA and civil or administrative actions helps avoid jurisdictional conflicts and promotes consistent case strategy.

- Remedial Leverage: Many enforcement agencies favor pre-determination settlements. Counsel can use reinstatement or back pay demands as leverage to negotiate broader monetary relief.

The Role of Corporate Compliance Programs

How organizations can mitigate retaliation risks:

- Independent reporting channels (e.g., third-party hotlines);

- Clear anti-retaliation policies in employee handbooks;

- Manager training to identify and prevent retaliatory conduct;

- Prompt, impartial investigations of complaints; and

- Audit committee oversight of whistleblower cases and internal controls.

Companies that fail to maintain effective whistleblower and compliance mechanisms risk being viewed as resistant to transparency — a perception that regulators and courts increasingly consider when assessing enforcement actions and penalties.

Emerging Trends and Global Perspectives

The European Union Whistleblower Directive (2019/1937) and related national laws are reshaping cross-border compliance expectations for multinational corporations. U.S. firms with European subsidiaries must ensure alignment between U.S. and EU standards, particularly regarding anonymity, internal reporting channels, and data protection under the General Data Protection Regulation (GDPR).

Domestically, Congress continues to expand whistleblower protections — most recently through the Anti-Money Laundering (AML) Whistleblower Improvement Act of 2022, which enhances protections for individuals reporting sanctions and money-laundering violations.

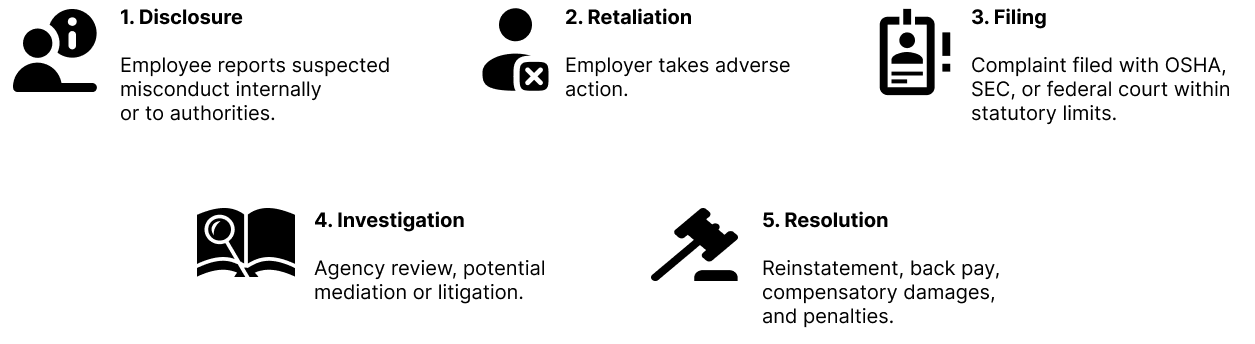

Flowchart: Anatomy of a Whistleblower Retaliation Case

Conclusion

Whistleblower retaliation law sits at the crossroads of employment regulation, corporate compliance, and public policy. Current enforcement trends point toward broader protections, higher penalties, and greater regulatory scrutiny. Both employers and employees benefit from approaching whistleblower matters with strategic foresight and legal precision — employees to safeguard their rights, and employers to minimize exposure while fostering a culture of integrity and compliance.

English

English  Español

Español  Русский

Русский  Turkish

Turkish  Persian (فارسی)

Persian (فارسی)  Arabic (العربية)

Arabic (العربية)  简体中文 (中国)

简体中文 (中国)