OFAC Subpoena: Enforcement Risk, Timelines, and Strategic Response Across Industries

An Office of Foreign Assets Control (OFAC) subpoena is one of the most serious enforcement tools the U.S. Treasury uses in sanctions investigations. While it is administrative in form, it signals a clear shift from routine compliance oversight to active enforcement scrutiny.

Key points for companies and executives:

- An OFAC subpoena does not accuse the company of wrongdoing — but it does place the company inside a formal enforcement investigation.

- OFAC enforces sanctions under a strict civil liability framework. Criminal exposure can also arise if the matter is reviewed in parallel by the U.S. Department of Justice.

- Written responses matter. How the company explains the facts, context, and compliance controls can directly influence whether OFAC views the conduct as negligent, contained, or potentially willful.

- Many of OFAC’s largest penalties stem from how companies respond to subpoenas, not from the original transactions themselves.

- Early involvement of experienced sanctions counsel can materially influence the outcome, helping ensure responses are accurate, credible, and aligned with enforcement expectations.

What Is an OFAC Subpoena?

An OFAC subpoena is a compulsory administrative demand issued under the International Emergency Economic Powers Act (IEEPA) and 31 C.F.R. Part 501. It requires the recipient to produce documents, electronically stored information, and written explanations related to potential violations of U.S. sanctions laws.

While it is not a formal accusation or finding of liability, an OFAC subpoena is legally binding. It creates immediate obligations—including preserving relevant records and responding within specified deadlines.

Typical characteristics include:

- Broad scope across facts and time periods. OFAC often looks beyond a single transaction to understand patterns, controls, and decision-making.

- Requests for both documents and written explanations. OFAC is not only reviewing what happened, but also how and why it happened.

- Close attention to ownership, control, and intent. Questions often focus on beneficial ownership, counterparty relationships, and what the company knew—or should have known.

- Coordination with other U.S. enforcement authorities. Information may be shared with agencies such as the Department of Justice or federal regulators.

- Real legal and reputational stakes. Outcomes can include civil penalties, potential criminal exposure in serious cases, and lasting business consequences.

In practical terms, a subpoena signals that OFAC has moved from passive monitoring to actively evaluating whether enforcement action may be warranted.

Why OFAC Issues Subpoenas

OFAC subpoenas are rarely triggered by a single transaction. More often, they follow patterns or risk signals that suggest deeper compliance concerns.

Common triggers include:

- Blocked or rejected transactions reported by banks. Financial institutions are required to report sanctions-related holds, which can prompt further review.

- Indirect dealings with Specially Designated Nationals (SDNs). Exposure through agents, distributors, intermediaries, or layered counterparties can draw scrutiny—even if the SDN is not immediately visible.

- Offshore entities or complex ownership structures. Multi-layered corporate arrangements can raise questions about who ultimately owns or benefits from a transaction.

- Voluntary self-disclosures that raise follow-up questions. A disclosure intended to resolve an issue can sometimes lead OFAC to request deeper documentation and explanation.

- Referrals from other U.S. enforcement agencies. Agencies such as DOJ, BIS, FinCEN, or DHS regularly share information where sanctions exposure may exist.

- Data-driven pattern detection. Repeated transactions involving sanctioned jurisdictions, high-risk regions, or recurring counterparties can trigger enforcement interest—even if individual transactions seemed routine.

OFAC’s enforcement approach is fundamentally risk-based and pattern-driven. In practice, this means regulators are often looking less at one isolated event and more at whether underlying compliance controls were sufficient to prevent repeated exposure.

What OFAC Subpoenas Commonly Demand

OFAC subpoenas typically request information across several core categories:

Transaction records

Payments, invoices, contracts, shipping records, and logistics documentation—anything that shows what happened, when, and why.

Counterparty information

Details about who was involved, including ownership, control, and beneficial ownership. OFAC wants to understand who ultimately stood behind the transaction.

Communications

Emails, internal messages, approval chains, and escalation records. These often reveal what people knew, what questions were raised, and how decisions were made.

Compliance materials

Sanctions screening procedures, internal policies, training records, and audit results. This helps OFAC evaluate whether the company had effective safeguards in place.

Narrative responses

Written explanations describing the intent behind the transactions, the compliance controls in place, and the internal decision-making process.

Critical enforcement issue:

Narrative responses often shape OFAC’s view of the case. They can influence whether regulators see the conduct as a good-faith mistake—or as something more serious, with significantly higher penalty exposure.

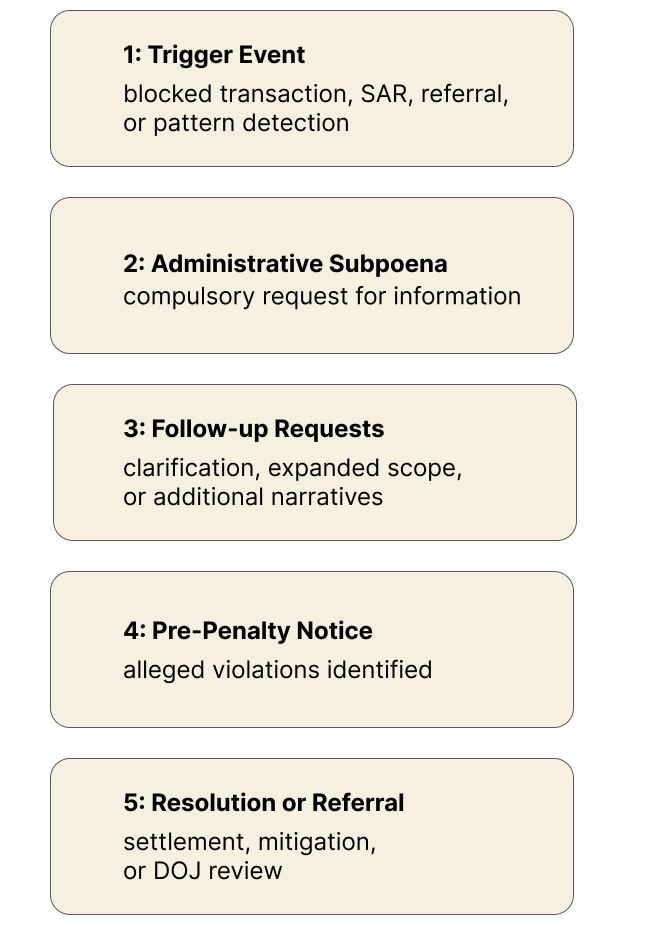

OFAC Enforcement Timeline

While timelines vary, most OFAC investigations follow a recognizable progression:

Most investigations last 12 to 36 months, with legal exposure increasing at each stage.

Civil, Criminal, and Collateral Exposure

Civil Exposure

OFAC operates under a strict-liability regime. Penalties are assessed per violation, regardless of intent, though intent affects severity.

Criminal Exposure

Criminal liability requires willfulness and is typically reviewed by the U.S. Department of Justice. Willfulness may be inferred from conduct, internal communications, and responses to OFAC inquiries.

Collateral Consequences

- Banking de-risking and account closures

- Contract termination and licensing impact

- Export-control restrictions

- Reputational and investor harm

- Conflicts with foreign data-protection or bank-secrecy laws

Cross-Industry Risk Patterns

Energy, Shipping, and Commodities

Primary risk pattern: hidden nexus + opaque logistics. Authorities scrutinize whether a company can reliably identify the vessel, beneficial owner, cargo, origin, destination, and end-customer — and whether it can prove that analysis with contemporaneous records.

-

Vessel obfuscation and re-flagging

-

Tactics: AIS gaps/spoofing, “going dark,” ship-to-ship (STS) transfers, last-minute port changes, frequent flag changes, and complex ownership/management chains (special-purpose entities, nominee directors).

-

Compliance failure mode: Reliance on basic name screening while failing to run IMO-level checks, beneficial ownership review, or voyage/cargo corroboration (charterparty, bills of lading, certificates of origin, terminal records).

-

Red flags: Unexplained routing, inconsistent cargo documentation, repeated use of high-risk waters/ports, “new” counterparties that cannot explain asset provenance.

-

-

Use of intermediated trading structures

-

Tactics: Multiple brokers, back-to-back trades, offshore “trading” entities, layering of contracts that obscures the real buyer/seller or the ultimate delivery point.

-

Compliance failure mode: Weak “know-your-counterparty” and end-use controls—accepting generic representations without verifying who controls the trade, who finances it, and who ultimately receives the commodity.

-

What regulators expect: Risk-based due diligence on traders/brokers, clear allocation of compliance responsibilities in contracts, and an auditable trail that reconciles contract → shipment → payment → delivery.

-

International Trade and Manufacturing

Primary risk pattern: diversion risk + channel opacity. Enforcement focus is typically on whether the exporter/manufacturer maintained end-use/end-user diligence proportionate to the product’s sensitivity and the destination risk.

-

Re-exports through third countries

-

Tactics: Transshipment hubs, “last-mile” forwarding through third countries, split shipments, and resale shortly after import to conceal the true end-destination.

-

Compliance failure mode: Treating the immediate purchaser as the end-user; failing to verify ultimate consignee, end-use statements, or downstream distribution controls.

-

Red flags: Customer refuses end-use certification, routing inconsistent with customer operations, payment from unrelated parties, sudden order spikes, or unusual product mix for the stated business.

-

-

Distributor risk and dual-use goods violations

-

Tactics: Use of distributors/resellers to access restricted end-users, misclassification, or shipment of controlled items without required licenses or controls.

-

Compliance failure mode: Inadequate export classification and screening, weak controls over “dual-use” products, and insufficient oversight of distributor compliance programs.

-

What regulators expect: Documented ECCN/classification methodology (where applicable), end-use/end-user diligence, distributor agreements with compliance covenants, training, audit rights, and escalation triggers.

-

Unifying enforcement theme

Indirect exposure + weak proof = liability risk.

Across industries, regulators consistently take the position that “we didn’t know” carries little weight if the company cannot demonstrate three core elements:

- Risk-based diligence: A clear understanding of who is involved, what is being transferred, where it is going, and why the transaction makes commercial sense.

- Control effectiveness: Evidence that screening systems, escalation procedures, and governance controls actually function—and that decisions are reviewed and documented.

- Documented rationale: Contemporaneous records showing why a transaction was cleared, licensed, or approved at the time—not reconstructed later.

In enforcement practice, liability risk often arises less from the transaction itself and more from the inability to prove that proper controls existed and were applied.

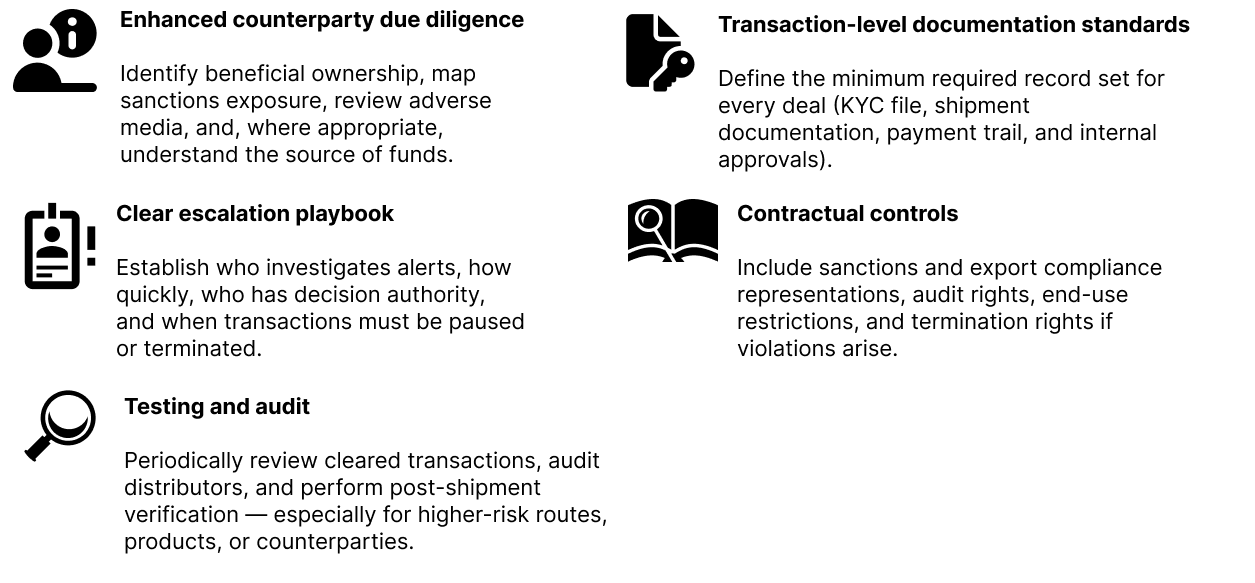

Practical control improvements worth implementing and documenting include:

Strong compliance programs are not defined by policies alone, but by the organization’s ability to show — through records and controls — that risk was actively identified, assessed, and managed.

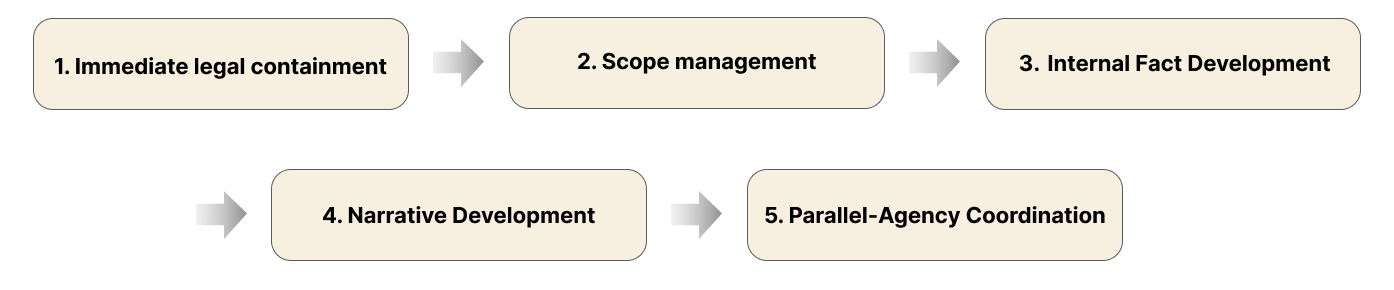

Strategic Response to an OFAC Subpoena

An effective response to an OFAC subpoena requires a deliberate legal strategy—not ad-hoc document production. How a company responds in the early stages often shapes the entire enforcement outcome.

1. Immediate Legal Containment

- Evidence preservation and formal litigation holds

- Centralized response management under legal counsel

- Protection of legal privilege from the outset

This phase is about stabilizing the situation and ensuring that information is preserved and handled in a controlled, defensible way.

2. Scope Management

- Negotiating custodians, date ranges, and production sequencing

- Clarifying OFAC’s investigative focus—without making admissions

Careful scope management helps prevent unnecessary exposure while ensuring the response remains credible and cooperative.

3. Internal Fact Development

- Mapping transactions and funds flows

- Analyzing counterparty ownership and control structures

- Assessing whether sanctions-compliance controls functioned effectively

This step allows the organization to understand its own risk profile before presenting explanations externally.

4. Narrative Development

OFAC evaluates enforcement matters under its Economic Sanctions Enforcement Guidelines, with particular focus on:

- Willfulness

- Harm to sanctions policy objectives

- Compliance program maturity

- Degree of cooperation

Clear, evidence-based explanations can materially reduce liability exposure. In contrast, inconsistent or speculative responses often increase enforcement risk.

5. Parallel-Agency Coordination

OFAC investigations frequently overlap with other regulators, including:

- DOJ (criminal exposure)

- BIS (export-control implications)

- FinCEN (AML and suspicious activity reporting considerations)

Coordinated strategy across agencies is critical to managing broader regulatory exposure.

Common mistakes that escalate OFAC investigations

- Treating subpoenas as routine compliance inquiries

- Producing documents without a clear legal strategy

- Providing inconsistent explanations across departments

- Overlooking indirect exposure risks (such as ownership or intermediary involvement)

- Responding without sanctions-experienced legal counsel

In practice, many of OFAC’s largest enforcement outcomes are driven less by the original transaction and more by how the organization handled the subpoena response.

FAQ

Is an OFAC subpoena public?

No. OFAC subpoenas are confidential administrative tools. That said, the outcome may later become public if OFAC announces a settlement or penalty. Separately, banks or counterparties may take protective action if they become aware of the investigation.

Who should control the subpoena response inside a company?

The response should be centralized under legal counsel, ideally with sanctions enforcement experience. Decentralized responses across compliance, finance, or business units often create inconsistencies that increase enforcement risk.

Can a company miss an OFAC subpoena deadline?

Deadlines are legally binding. However, extensions and phased (rolling) productions are often granted if requested early and supported by a realistic production plan. Ignoring deadlines or responding late significantly increases risk.

What happens if the company provides incomplete or incorrect information?

Incomplete or inaccurate responses can have serious consequences, including:

- Follow-up subpoenas or additional information requests

- Increased likelihood that OFAC infers willfulness

- Loss of mitigation credit

- Separate violations for false or misleading statements

In many cases, OFAC evaluates the quality of the response as closely as the underlying conduct.

Does attorney–client privilege apply?

Yes, but only if the response is structured properly from the beginning. Poorly managed internal reviews can accidentally waive privilege or expose sensitive internal analysis.

Can OFAC subpoena individuals, not just companies?

Yes. OFAC can subpoena officers, directors, employees, and third parties – especially where individual knowledge, intent, or decision-making is relevant.

Can foreign companies or non-U.S. persons receive OFAC subpoenas?

Yes. OFAC regularly subpoenas:

- Foreign companies with a U.S. nexus

- Non-U.S. persons using U.S. banks or U.S. dollar transactions

- Foreign subsidiaries of U.S. companies

Jurisdiction often arises from U.S. dollar clearing, U.S. financial institutions, U.S. persons, or U.S.-origin goods.

What if foreign law restricts document production (for example, GDPR or bank secrecy)?

Foreign legal restrictions do not eliminate the obligation to respond but they must be raised early. OFAC may allow practical accommodations, such as:

- Redactions

- Phased productions

- Alternative formats

- Formal explanations of legal constraints

Failure to address these conflicts early can be viewed as non-cooperation.

Will receiving a subpoena automatically lead to criminal charges?

No. Criminal exposure arises only if willful violations are identified and the matter is referred to the U.S. Department of Justice. However, OFAC subpoenas are often part of a broader enforcement framework that may include criminal review.

Should the company continue communicating with banks or counterparties during the investigation?

Only with legal guidance. Uncoordinated communications can:

- Create inconsistent narratives

- Trigger account closures or de-risking

- Produce records that may later be reviewed by regulators

Does cooperation guarantee no penalty?

No. Cooperation helps but it is not a defense. Mitigation credit depends on:

- Timeliness

- Completeness

- Credibility

- Consistency

- Meaningful remedial action

Delayed or incomplete cooperation often carries limited weight.

Can companies negotiate with OFAC?

Yes. Most cases resolve through negotiated settlements, which may include:

- Reduced penalties

- Structured payment terms

- No-admission language

- Compliance improvement commitments

Importantly, settlement leverage is shaped by how the company responds from the very beginning.

What remedial steps does OFAC expect during an investigation?

OFAC expects companies to take real, immediate corrective action, such as:

- Improving screening systems

- Updating internal policies and controls

- Providing targeted staff training

- Taking disciplinary action where appropriate

Proactive remediation is far more effective than waiting until the investigation concludes.

When should sanctions counsel be involved?

Immediately. Ideally, upon receipt of a subpoena, or earlier if a red flag arises. Early involvement helps ensure:

- Controlled scope and messaging

- Consistent and credible explanations

- Protection of legal privilege

- Stronger mitigation and settlement outcomes

Conclusion

An OFAC subpoena is not just a routine regulatory request — it’s a critical enforcement signal. How a company responds can shape the scope of liability, financial exposure, and reputational impact. While timelines and document requests can sometimes be negotiated, that flexibility only comes with early, proactive engagement.

Importantly, many penalties arise not from the underlying conduct itself, but from mistakes, omissions, or inconsistent explanations in the response.

In short, an OFAC subpoena, though administrative on paper, carries serious legal, financial, and operational risk. Companies that respond strategically, building facts carefully, controlling the narrative, and involving sanctions-experienced counsel early — stand a far better chance of mitigating exposure, preserving defenses, and, in many cases, avoiding penalties entirely.

English

English  Español

Español  Русский

Русский  Turkish

Turkish  Persian (فارسی)

Persian (فارسی)  Arabic (العربية)

Arabic (العربية)  简体中文 (中国)

简体中文 (中国)