BIS Investigations: A Comprehensive Guide to Export Control Enforcement and Defense

A BIS investigation is one of the most serious enforcement risks in international trade. The Bureau of Industry and Security (BIS), part of the U.S. Department of Commerce, enforces the Export Administration Regulations (EAR): the rules that control how U.S.-origin goods, software, and technology can be exported, reexported, or transferred between countries.

What makes BIS different is the level of consequences. These cases often go beyond administrative penalties and can escalate into criminal investigations, export bans, and even personal liability for executives and employees. Enforcement risk is especially high in matters involving China, Russia, Iran, dual-use technologies, semiconductors, aerospace, AI, energy, and advanced manufacturing.

What Is a BIS Investigation?

A BIS investigation is an administrative enforcement proceeding that can result in:

- Civil monetary penalties

- Administrative denial of export privileges

- Criminal referral to the U.S. Department of Justice

- Parallel sanctions exposure involving OFAC

Crucially, many EAR violations impose strict liability, meaning intent is not required for enforcement.

Why BIS Enforcement Is Especially Dangerous

BIS differs from traditional regulators in several critical ways:

- Global jurisdiction over U.S.-origin items

- Authority over technology access, cloud sharing, and source code

- Ability to sanction foreign companies and individuals

- Close coordination with prosecutors and intelligence agencies

Companies often underestimate BIS exposure until operations are already at risk.

Legal Foundations of BIS Investigations

1. EAR Jurisdiction

BIS controls:

- U.S.-origin items worldwide

- Certain foreign-made items under FDPR rules

- Deemed exports to foreign nationals

2. Export Classification (ECCN)

Misclassification is one of the most common and costly errors. Incorrect ECCNs frequently invalidate license exceptions and create retroactive violations.

3. Licensing and Exceptions

BIS closely reviews:

-

Improper reliance on license exceptions

-

Unsupported end-use statements

-

Distributor-based compliance models

4. Knowledge and “Red Flags”

The EAR defines knowledge broadly, including:

- Actual knowledge

- High probability awareness

- Conscious avoidance

Ignoring red flags is treated as willful conduct.

What Triggers a BIS Investigation?

Common triggers include:

- Voluntary self-disclosures (VSDs)

- Bank and freight-forwarder referrals

- Customs export filing inconsistencies

- Sanctions reviews that spill into EAR exposure

- Whistleblower complaints

- Intelligence and allied government referrals

Many investigations begin without prior warning.

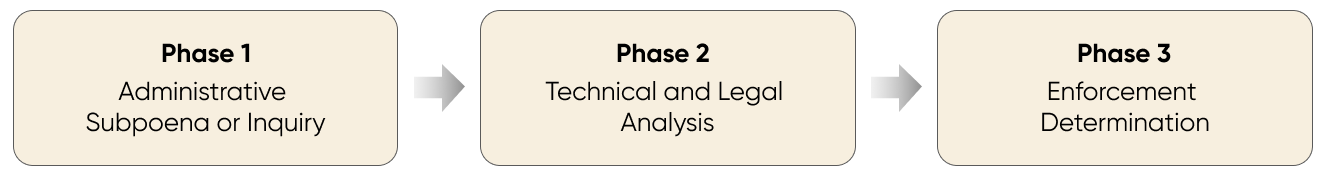

The BIS Investigation Process (Step by Step)

Phase 1: Administrative Subpoena or Inquiry

BIS may request:

- Export records and AES filings

- Technical specifications

- Internal emails and contracts

- Compliance procedures

Everything provided becomes enforcement evidence.

Phase 2: Technical and Legal Analysis

BIS conducts:

- Engineering classification review

- Transaction mapping over multiple years

- End-use and end-user reconstruction

Additional violations are often identified at this stage.

Phase 3: Enforcement Determination

Possible outcomes include:

- Warning letter

- Civil penalties (often per-shipment)

- Denial of export privileges

- Criminal referral

Civil vs. Criminal BIS Exposure

|

Category |

Civil Enforcement |

Criminal Enforcement |

|

Standard |

Strict liability |

Willful conduct |

|

Penalties |

Fines, denial orders |

Prison, criminal fines |

|

Targets |

Companies & individuals |

Individuals & executives |

|

Collateral risk |

Licensing bans |

Enterprise-threatening |

BIS has increasingly emphasized individual accountability.

BIS and Multi-Agency Enforcement Risk

Many export cases involve stacked exposure, including:

- BIS (EAR violations)

- OFAC (sanctions)

- DOJ (criminal statutes)

- Homeland Security (false statements, smuggling)

A single transaction may violate multiple laws simultaneously.

Voluntary Self-Disclosure: Use With Caution

A properly structured VSD can significantly mitigate penalties.

An improperly prepared VSD can:

- Expand investigative scope

- Create binding admissions

- Trigger criminal escalation

Effective disclosures require:

- Verified scope of violations

- Accurate ECCN analysis

- Root-cause identification

- Documented remediation

Timing and legal framing are critical.

Export Compliance Programs as Mitigation Evidence

BIS evaluates whether a company has:

- Formal classification procedures

- End-user and end-use screening

- Role-specific training

- Audit and escalation controls

- Executive-level oversight

“Paper compliance” programs provide little to no protection.

Critical Mistakes During BIS Investigations

- Responding without export-control counsel

- Treating BIS matters as logistics issues

- Making informal or speculative statements

- Continuing exports during review

- Ignoring OFAC overlap

Once violations are established, mitigation options narrow rapidly.

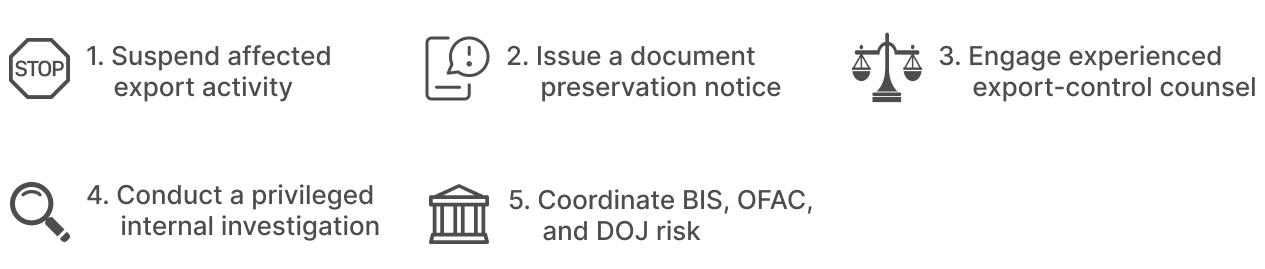

Best-Practice Response Strategy

Upon any BIS inquiry, companies should immediately:

Early legal control frequently determines the outcome.

Frequently Asked Questions (FAQ): BIS Investigations and Export Control Enforcement

What is a BIS investigation?

A BIS investigation is an enforcement inquiry into potential violations of U.S. export control laws, specifically the Export Administration Regulations. It may involve administrative subpoenas, document requests, interviews, and technical reviews of exported items, software, or technology. These investigations can lead to civil penalties, export bans, or criminal referrals.

What triggers a BIS investigation?

Common triggers include voluntary self-disclosures, bank or freight-forwarder referrals, anomalies in export filing data, whistleblower complaints, sanctions-related transaction reviews, and intelligence or allied government referrals. Many investigations begin without advance notice to the company.

Can BIS investigate foreign companies or non-U.S. persons?

Yes. BIS has broad extraterritorial jurisdiction. Foreign companies and individuals may be subject to investigation if they export, reexport, transfer, or otherwise deal in U.S.-origin items or foreign-made items subject to U.S. export controls. BIS can also impose denial orders worldwide.

What is a BIS administrative subpoena?

A BIS subpoena is a formal legal demand requiring a company or individual to produce documents, data, or testimony relevant to an export control investigation. Responses must be accurate and complete. False or misleading statements may constitute independent violations.

Is intent required for BIS penalties?

Not always. Many export control violations are subject to strict liability, meaning a company can be penalized even without intent or knowledge. However, willful conduct significantly increases exposure and may lead to criminal enforcement.

What penalties can result from a BIS investigation?

Penalties may include civil monetary fines (often assessed per violation), denial of export privileges, placement on restricted party lists, seizure of goods, and criminal prosecution. In severe cases, penalties can threaten the company’s ability to operate internationally.

Can individuals be personally liable in BIS cases?

Yes. BIS increasingly pursues individual liability. Executives, compliance officers, engineers, and employees may be named personally if they participated in, authorized, or ignored export control violations.

How long does a BIS investigation take?

The timeline varies. Investigations may last several months or extend multiple years, particularly where complex technology, multi-jurisdictional exports, or potential criminal exposure is involved.

Should a company continue exports during a BIS investigation?

Often, no. Continuing potentially violative exports during an investigation can dramatically worsen exposure. Companies should promptly assess whether exports must be suspended and implement risk-containment measures under legal guidance.

What is a Voluntary Self-Disclosure (VSD) to BIS?

A VSD is a formal disclosure by a company identifying potential export control violations. When properly prepared and timely submitted, a VSD may substantially reduce penalties. Poorly prepared disclosures, however, can expand liability and trigger criminal scrutiny.

How does BIS enforcement differ from OFAC sanctions enforcement?

BIS focuses on export controls, while OFAC administers economic sanctions. Many cases involve overlap, meaning the same transaction may trigger both export control and sanctions violations. Coordinated legal strategy is essential to manage multi-agency risk.

Do compliance programs actually reduce BIS penalties?

Yes, but only if they are credible and operational. BIS evaluates whether a company maintains effective classification procedures, screening systems, training programs, audits, escalation protocols, and executive oversight. “Paper compliance” programs provide little mitigation.

What should a company do first after receiving a BIS inquiry?

Immediate steps typically include issuing a document preservation notice, suspending risky exports, engaging experienced export-control counsel, and conducting a privileged internal investigation before communicating substantively with the government.

Does a BIS investigation automatically become criminal?

No, but criminal escalation is possible. Civil matters may be referred for criminal prosecution where BIS identifies willfulness, concealment, false statements, or evasion tactics. Early strategic handling is critical to keeping matters civil.

Will a BIS investigation become public?

Many enforcement actions are eventually published, particularly where penalties or denial orders are imposed. Even non-public investigations can create significant reputational, banking, and transactional consequences.

Do mergers, acquisitions, or investments trigger BIS scrutiny?

Yes. Export control violations often surface during due diligence. Unresolved BIS exposure can delay or derail transactions, affect valuation, or lead to successor liability.

When should export-control counsel be involved?

Immediately. Early legal involvement helps control the investigative narrative, preserve privilege, assess disclosure options, and prevent missteps that can convert regulatory exposure into criminal liability.

Conclusion: BIS Investigations Are High-Risk Legal Events

A Bureau of Industry and Security investigation is not routine regulatory oversight. It is a national-security enforcement process that can disrupt global operations, trigger criminal exposure, and cut off a company’s ability to export altogether.

For that reason, BIS scrutiny should be treated as a board-level legal emergency. Companies that engage experienced export-controls counsel early, before narratives form and positions harden, are far better positioned to contain risk, protect operations, and preserve long-term market access.

English

English  Español

Español  Русский

Русский  Turkish

Turkish  Persian (فارسی)

Persian (فارسی)  Arabic (العربية)

Arabic (العربية)  简体中文 (中国)

简体中文 (中国)